Banks Know You by Your Credit Score!

Why do you need good credit or high credit scores? A good credit score can mean access to better borrowing terms and lower interest rates, but it also brings other benefits like lower insurance rates, access to better credit cards and greater options for renting houses or apartments.

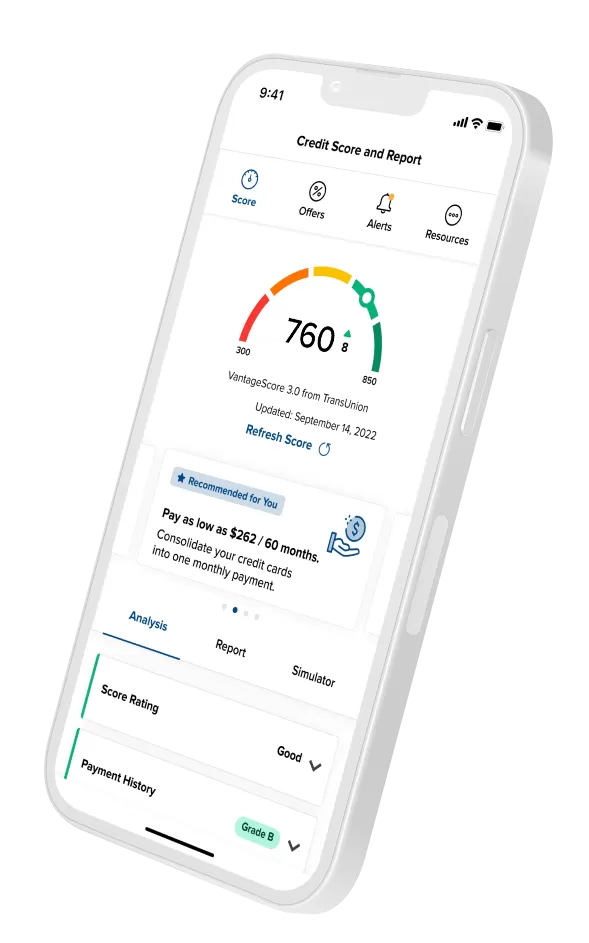

Most lenders consider a FICO® Score of 700 or above to be a good credit score. Contact me to discuss your options. My Personal Credit Advisor can help you increase your recredit scores by helping you clean your credit.

Good Credit Gets You

Insurance Discounts

Employment

Credit card benefits

Lower interest rates

Higher credit limits

Rental applications

Better loan terms

Credit applications

Skip utility deposits

Reasons why you need good credit:

- Significant Savings on Interest: Borrowers with the highest credit scores generally have access to the lowest interest rates available on mortgages and auto loans. Lower rates = big savings!

- Better Terms and Access to Loan Products: Lenders use credit scores when deciding what type of loan, they will offer you. Each lender sets its own lending criteria, but, for example, a hypothetical mortgage issuer might have a policy of refusing loan applicants with FICO® Scores below 620, offering only adjustable-rate mortgages to applicants with scores between 620 and 699, and fixed-rate loans only to applicants with scores above 700.

- Access to the Best Credit Card Rewards: Like mortgage and auto lenders, credit card issuers use credit score cut-offs in decisions about which cards you qualify for.

- Insurance Discounts: Car insurance companies in many states use specialized credit-based in credit-based insurance scores to help decide whom they'll cover and what premium they'll charge a given policyholder. Insurance scores are not the same as those lenders use for credit applications but are similarly derived from information in your credit reports.

- More Housing Options: Many landlords and property management companies check potential tenants' credit scores to gauge their level of financial responsibility. A low score could prevent your application from being approved or cause you to be charged a higher security deposit on a rental house or apartment.

- Security Deposit Waivers on Utilities: Utilities including internet providers, cable companies and satellite dish companies may review your credit reports and scores in order to assess their risk in taking you on as a customer. If you lack a strong credit history, they may require a security deposit.